신뢰할 수 있는 최고의 메이저사이트 추천 및 보증업체

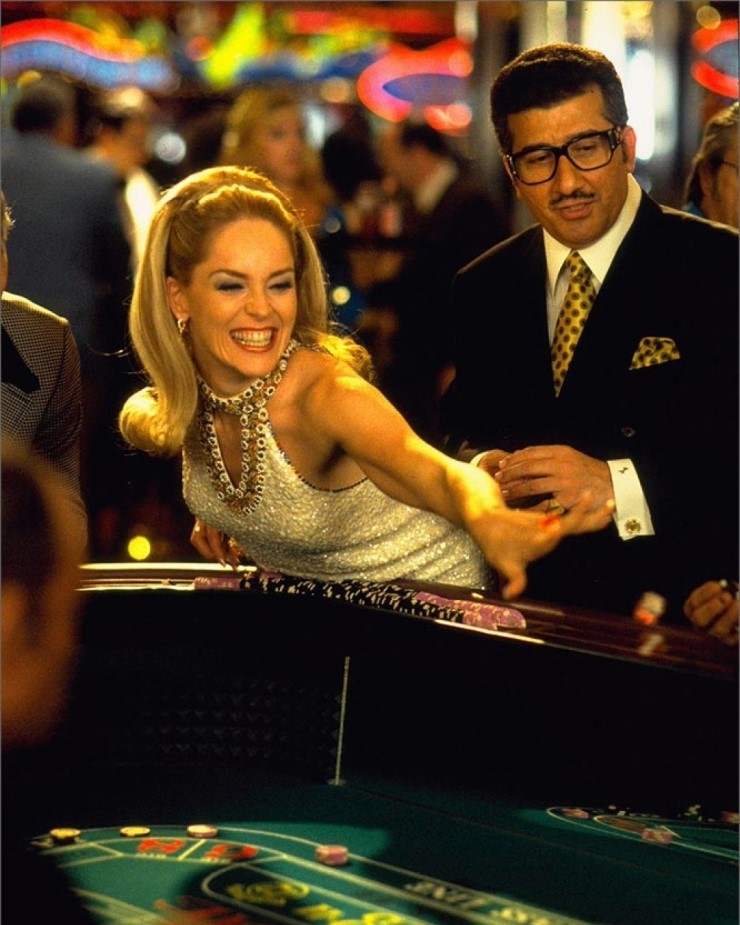

메이저사이트의 정의와 중요성 메이저사이트는 사용자들에게 안전하고 신뢰할 수 있는 온라인 토토 및 카지노 플랫폼을 제공합니다. 이러한 사이트들은 엄격한 검증 과정을 통과하며, 고객 만족과 보안을 최우선으로 삼습니다. 사용자는 메이저사이트를 통해 다양한 게임과 베팅 옵션을 안전하게 이용할 수 있으며, 고품질의 서비스를 경험할 수 있습니다. 토토친구와 메이저사이트의 연계 토토친구는 메이저사이트의 풍부한 정보를 제공하는...